At NSW Mortgage Corp, our team understands that there is more than one reason Australians want to refinance and we believe you should benefit being a home owner.

At NSW Mortgage Corp, we help people across Australia identify the leading home loans, mortgage solutions, refinancing options, debt consolidation loans, business loans, secured and unsecured personal loans and many other loan products on the market. Our customers come from all walks of life and all circumstances, some with poor credit histories. Our mortgage solutions are flexible, competitive and tailored to best suit your situation.

No matter what stage your are in your financial life, we aim to create mortgage solutions, business or personal loan option to suit your specific needs.

We can help save you money through consolidating higher interest loans into a simple repayment generally with a lower interest rate, so you can save.

Online application is super fast and we will get in touch as soon as possible, and it will not impact your credit rating to apply on this website.

Access our flexible personal loans, business loans, refinance home loans, short term loans and many more to suit your lifestyle and needs. We also offer no credit check application options for people with bad credit.

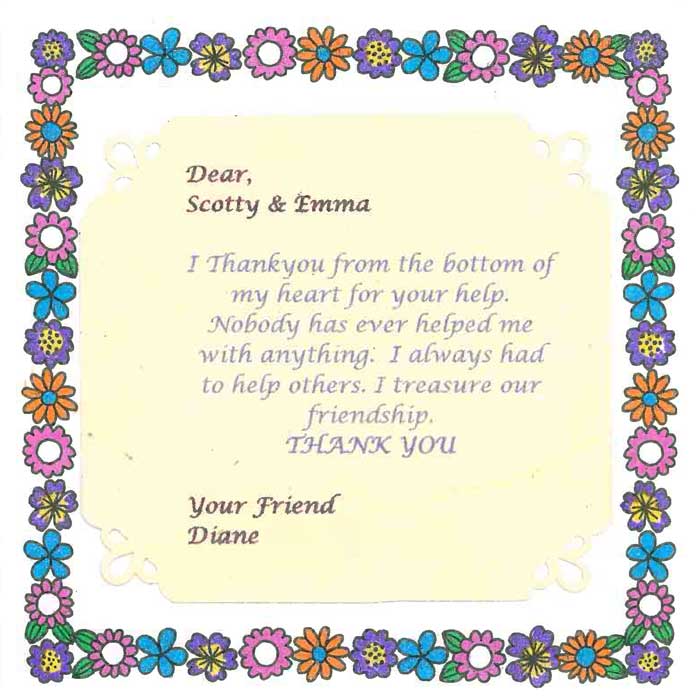

We’ve helped many people from all over Australia find the best financial solutions to their problems. Read genuine testimonials from our happy customers and find out how we helped them with our range of products.

Compare interest rates to get the best loan for your needs. We strive to provide our customers with the most comprehensive competitive rates and comparison rates available for your customer satisfaction.

Plan your personal loan, business loan or mortgage efficiently by using our complimentary financial calculators including loan repayment calculator, loan comparison calculator and budget planning calculator.

NSW Mortgage Corp are here to support you, no matter what your financial situation. We have mortgage solutions to suit most Australians.

When you have bad credit, a loan of any description can affect your ability to get affordable finance. Banks can turn you down because they see just the credit score not the person. Then with each application, banks check your credit file leaving a credit enquiry on your file, which can lower your credit score even more.

At NSW Mortgage Corp we look at all aspects of your financial situation to determine your borrowing power.

When the banks so no, we can most often find a way forward. We don’t just offer great options for mortgages, we also offer bad credit loans.

We started out offering quality finance to NSW but quickly expanded to cover the whole of Australia. Over the past 30 or more years we have had customers from all the capital cities, Sydney, Melbourne Brisbane, Perth, Hobart, Darwin, Canberra and Adelaide, as well as those from regional areas outside NSW.

Our goal at NSW Mortgage Corp is to provide the best service online and by phone so you get expert advice and the best loans, mortgages, refinance options, from anywhere in Australia, from your computer or smart phone.

We have a central office based in South Strathfield, Sydney with our staff based there and from home workstations since the COVID19 crisis.

Absolutely! Call between 8.30 am – 11.30 pm Monday – Sunday on 1300 137 778. You will speak with a real person, one of our highly trained loan specialists.

In order to keep our staff safe and continue our fantastic customer service, we have set our experts up with home based work stations, as well as work stations in our central office. Our staff have the option to work from home or the office. Our large office allows for social distancing and we have put in place all the recommended measures to keep staff safe. Vulnerable workers are able to work from home workstations with no interruption to our excellence in customer service.

Because all our services are online and via electronic forms, we are able to offer seamless service in these changing times.

Australia’s personal loan marketplace has the big four banks – Commonwealth Bank, ANZ, NAB, and Westpac – which dominate the lending market. These big banks currently hold 85% – 90% of the industry. With the personal loan marketplace here in Australia worth $26billion per year, this is a lucrative lucrative opportunity.

The big drawback of taking a personal loan from the big four banks is that because personal loans aren’t their primary focus, consumers aren’t always sold what is necessarily the best deal for them. With the big banks, there is a lack of flexibility available in personal loan products, and some people are treated as numbers, not individuals with unique circumstances. Customer service is also not as personalised as it could be.

Our customers like non-bank lenders like NSW Mortgage Corp because we offer a more focused, individual service. We care about each and every applicant, and look beyond just a credit rating.

Just read through our Trust Pilot reviews and testimonials to see how much our customers appreciate our time and effort to get the best loan product for every customer.

At NSW Mortgage Corp we treat all of our customers as people people, not numbers. Every single loan application that comes through to us is assessed by one of our specialist lenders. You won’t be declined for a NSW Mortgage Corp loan because a computer system says you don’t score highly enough.

Occasionally an individual’s loan requirements are outside the scope of what we offer and these are referred directly to another specialist lender who can offer a solution.

NSW Mortgage Corp will support you from application to funds being transferred to your nominated bank account. Your journey and satisfaction is very important to us.

This is a common scenario – you are not alone. We understand sometimes life can throw a curve ball unexpectedly at us and you may have had difficulty with making payments on time. Our attentive and friendly team will look at your situation and discuss the best finance solutions available to you.

We will cover any up front costs that may be incurred and recover them once your loan is settled.

We lend to people living in rural areas across Australia – and have done for over 30 years!

At NSW Mortgage Corp we see you as an individual with a unique set of circumstances, not just your credit history. We offer a range of loans at competitive interest rates, to suit your current situation. For more on our rates, visit our interest rates page.

YES! NSWMC loan assessments are based on whether you can afford the loan and how appropriate it is for your situation. We practice responsible lending every step of the way. Just because you’re receiving benefits, doesn’t mean you can’t or shouldn’t get access to affordable finance.

You might want to think about other options before applying for a loan with NSWMC. Other options are:

Speaking with an independent financial counsellor.

Talk directly to your electricity, gas, phone or water provider to see if you can work out a payment plan.

Discuss an advance from Centrelink: www.humanservices.gov.au/advancepayments.

The Australian Government’s MoneySmart website is also a great place if you are facing financial hardship.

Stamp Duty is a state government duty payable when a property is purchased or transferred. Stamp Duty is calculated on the purchase price of the property and is paid by the buyer. Each State and Territory has a different rate of duty. Check out this stamp duty calculator to work out how much Stamp Duty will be payable on your property purchase.

An offset account is a transaction account that is linked to your home loan. An offset account allows you to deposit or withdraw from it as you would with your regular day to day account. The main difference is that if you hold money in your offset account over time, you can reduce the amount of interest on your home loan.