Can I Get A Mortgage With Bad Credit?

Having bad credit can be very restrictive, but if you’ve been wondering ‘Can I get a mortgage with bad credit? The answer is yes. Find out how here…

Having bad credit can be very restrictive, but if you’ve been wondering ‘Can I get a mortgage with bad credit? The answer is yes. Find out how here…

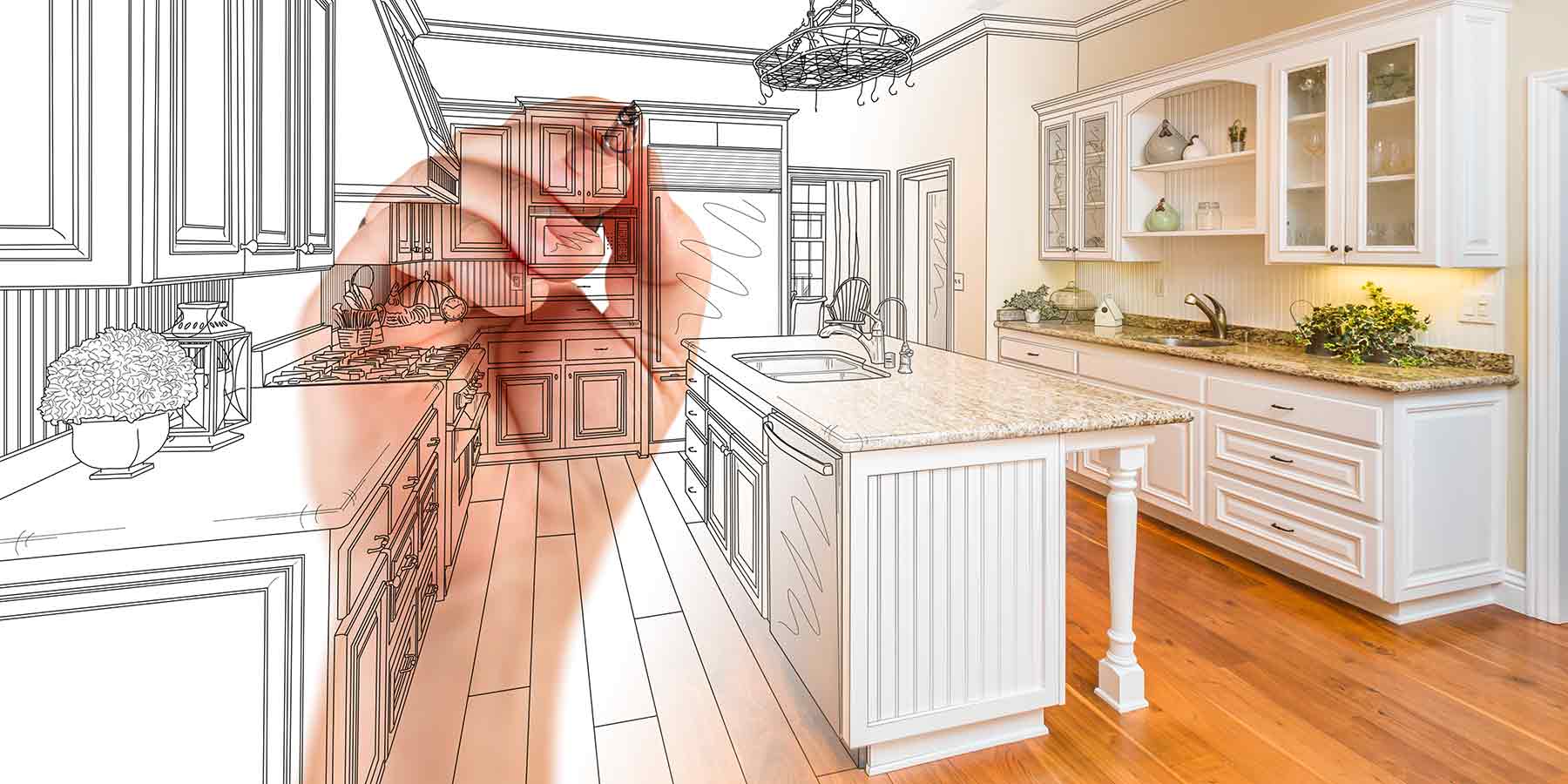

Home renovations can be exciting, refreshing, and also stressful. They can also be expensive… Learn what are home renovation loans and how they could help…

Getting on to the property ladder is a goal for many. But a property doesn’t have to be a home. Learn what is an investment property here & build your empire…

Are you looking to purchase a new house while you wait for your current one to sell? You don’t have to miss the opportunity. How does a bridging home loan work?

Bad credit can be hard to avoid, and it can make loan approval hard to come by. Find out all about bad credit home loans here in this ultimate guide.

Looking to mortgage a property but unsure if you can afford the deposit? How much deposit do I need for a home loan? Find out here!

Did you know there are many different types of mortgages for you to choose from? Find out what they are here and choose the right one for you!

When shopping for a mortgage lender, it is important to know which loan product would best fit your borrowing needs. Here are tips to help you weigh refinance vs second mortgage and how your choice can make a difference in your finances.

The fear of paying very high interests is one of the reasons borrowers dodge the idea of getting a home loan. Those who have gone through a foreclosure or bankruptcy are one of those people who think that a tanked credit will make them pay more than a borrower who has a stellar credit, but that’s not really true.

Refinancing makes financial sense, as the new loan may result in at least a 1 per cent decrease in your interest rate. If you are currently paying a mortgage with an 8 per cent interest rate, and you found a new mortgage with an interest rate of 6 per cent, you’ll be saving 2 per cent!

A second mortgage can also help you fill the gap especially when you’re in serious debt. Talk to our helpful mortgage advisers to answer your queries and give advice about your current finances and how you can pay for your obligations as judgements debtor.

When you are having difficulty in paying your first mortgage, you may want to consider taking a second mortgage to consolidate your loans and save more money in the process. Not only will you be able to spend the extra cash for your urgent needs, but you will also still have the opportunity to get a lower interest rate, and a more affordable monthly payment.

When you are faced with multiple debts and you no longer have enough money to pay for them all, and creditors, as well as credit collectors, are knocking at your doorstep, use your house as a shield.

Credit card debts, consumer debts and payday loans cost more than second mortgage or home equity loans. If you keep on relying on high-interest credits, and you missed payments several times—then you may want to consider getting a second mortgage. You can consolidate all your debts and take care of only one loan at a time.

Yes, being high-risk borrowers could mean higher interest rates, but it doesn’t mean that you’ll be in deeper trouble if you get a reasonable loan. It’s just a matter of learning the proper borrowing-and-repayment strategy.

Personal loans and home equity loans are two of the most availed financing options. In fact, they are relatively easy to get-because of less-strict lending requirements compared to other types of loans.

To qualify for a first time home loan, lenders would want to know your monthly income. Whether or not it is sufficient to meet your monthly mortgage plus other debt obligations will determine the amount you will qualify for.

Are you planning to buy your dream house? Remember that your borrowing capacity depends on various factors. Whether you’re planning to apply for poor credit

Dodging phone calls or letters from your mortgage lender, credit collectors and utility providers won’t help. Ignoring these payment reminders, especially about your mortgage interest rate or payments can end in forced sale.

Specialised lenders came up with innovative schemes to provide suitable options for home loans borrowers. But, despite the fact that there are various types of home financing, they are generally classified into two types: Fixed rate and variable rate loans.

Mortgage refinance is a strategy, and must not be taken lightly. Why do you want to refinance your home? It is important to list all your reasons before you take the plunge. If you want to lower your payment, then think about ways on how you can lower it.

Financial problems combined with the constant demands of caring for your young children can test your limits. The financial challenges of starting a family can also take a toll on your health.

A second mortgage is also tax-deductible. It has a simple and fast loan approval-which can be as fast as 24 hours or less. If you want to find some extra cash, get a second mortgage to tap into your home’s value. The amount of loan depends on the amount of ownership or “equity” you built up on your property over the years.

Keeping your finances under control doesn’t mean denying your children a comfortable life. It is just a matter of budgeting and sticking to it. The benefits of second mortgage is truly undeniable, it gets you out of a financial mess and helps you put your finances in order.

If you want to get out of credit card debt, second mortgages can be your best option. Sometimes credit cards can put you in a financial situation that makes you miserable more often than it makes you financially secure.

In this article, we will discuss the risks of getting a second mortgage. We will present some examples from which you may learn a thing or two and decide whether it is beneficial to get a second mortgage or not.

When you choose to refinance, you will take a new loan, and you will use it to pay the existing one. Sometimes, you will have a new lender, but you can also do this with the one you are using already.

Life can be tough, especially when we’re talking about money. Even so, you can’t mess around with home equity. If you know how it works, it can benefit you. This article is a brief guide on this subject.

It is always advised to do plenty of research before applying for a loan. It’s important to understand all the responsibilities it comes with. A second mortgage comes indeed with certain risks, but it does have several benefits as well.

There’s nothing wrong in shopping around and getting quotes from different sources. But, be sure that you are only making a no-credit-check inquiry. Otherwise, your future lenders will notice them on your credit file. They may interpret it as a desperate attempt to get as many loans as possible.

When you refinance a loan, you usually have to extend the loan period. While the mortgage interest rates of the new loan are lower; it means that you are also putting your home’s value at some else’s hand.

Accept the fact that the auction process can be an overwhelming and emotional experience. Bidding on an auction property is like going into battle. Don’t let your emotions rule over you.

Instead of extending the term of your loan to get lower monthly payments, it is advisable to pay larger instalments each month so you can pay your refinance loan quicker.

Moving your mortgage isn’t easy, and it doesn’t come cheap. But, if the financial advantages of the new lender outweigh the taxes you had to pay for your old loan, then go for it. Companies like us NSW Mortgage Corp have very convenient rates for the average Aussie, so don’t be afraid to enquire with us today.

If you’re interested in refinancing your loan, contact NSW Mortgage Corp and our in-house mortgage specialists will walk you though the process. We offer fast approval, high-appraisal and low-interest refinance loan. Make an enquiry today!

Second mortgages, just like any other secured loan comes with potential risk. That’s why it is important to enquire about the loan terms before getting them. Ask as much as you can about the loan, especially with regards to interests that may accumulate over time.

Some lenders offer interest-only payments to draw customers to apply for loans with low-interest payments. It is because as a borrower, you only have to pay the interest and none of the principal balance for a specified period of time which may take months or years.

Mortgage refinancing means paying an existing debt and then replacing it with a new one. So why should someone do this? What are the financial advantages of such a move? Let’s find out in today’s article.

Whether you can no longer pay you loans or you simply want to make them more convenient for you, the market today makes it much easier for home loan refinancing.

Does refinancing work and is there a downside of refinancing? Will it resolve the financial issues you’re having? The truth is this, refinancing without good financial planning cannot make a lasting change in your financial situation—it is only a temporary solution.

There are many things that would cost more than what a personal loan or any short-term loan could offer- roof replacement or repair, sewer line problems, and foundation problems. All of these projects are major repairs that may cost thousands of dollars depending on the scope of the problem.

Without a doubt, for many Aussies, a home loan accounts for the most considerable investment. It figures that many are looking for useful tips on

Being 100 percent loyal to your current home lender can cost you a considerable sum if you were to consider the course of the loan

If you want to borrow money using your existing mortgage, a refinance or a second mortgage can be your options. Here’s what you need to

Are you tempted to cash out the equity in your home by applying for a second mortgage? Before you fill up the application form, there

The secret to getting the most out of your secondary mortgage is not entirely the amount, but how you use it to work for your

We offer personal loans to help you buy a vehicle or maintain it, renovate your home, spend for your medical needs or pay outstanding bills and so on. If you think that debts are unmanageable and unforeseen expenses sprout out, we got you covered.

Do you want to take a second mortgage on your home? Before you sign the application form, here are things you need to know about

When the hammer falls, the decision is FINAL Put simply, there are two ways to buy a property – either a private sale, known as

With so many changes to Australia’s home loan market each year it’s your responsibility to keep up with the changes. There are plenty of new home loan products entering the market each year and many that may be more suitable for your budget, potentially saving you a huge amount of cash.

It’s important to understand which type of home loan best suits your needs and financial objectives. Once you’ve outlined your financial goals, you can begin to explore loan options that will help you reach them. Here is a quick overview of the most common home loans that are available on the market.

The lender usually will not have to sell the property to recover their money – the guarantor needs to treat this responsibility as if it were their own. If things do turn sour, a guarantor needs to be aware that it will affect their credit file as if they defaulted on their own loan.

Are you building or planning major renovations for your home or investment property? Here is a summary of the five major stages involved to do so.

You can use construction loans to purchase land and construct a house, to refinance an existing loan and construct a house, to finance the construction of house on existing land or to conduct minor renovations to a new or existing property.

Fear not, this is the ideal time to use a bridging loan. Bridging loans are temporary finance for an individual or business while waiting for something, such as the settlement of a property or obtaining a larger amount of finance.

Before hurrying to take a fixed rate home loan as soon as possible, you better compare the advantages and disadvantages of this borrowing option.

Striving to meet the high requirements necessitates funding so a rise in interest rate is not a surprise. The percentage may be a surprising aspect but the experts expected the increase itself. In fact, this is one of the reasons claimed by the chief executive officer of the Bank of Queensland, Jon Sutton, aside from the incredibly competitive market.

Most of us probably have a mortgage and with rising rates all over the place, you may be considering a refinance of your mortgage. While

Ever since the housing prices started to climb and the interest rates started to fall, people have been scrambling all over the country to snatch

It is undeniable that there are people who are still experiencing mortgage stress despite the current low rates. It becomes stressful whenever you can’t afford